A Buyer’s Market occurs when property supply exceeds buyer demand. In this scenario, buyers gain significant leverage in the transaction. Sellers may reduce prices, offer incentives like covering closing costs, or provide appliance upgrades to make deals more attractive.

This market dynamic contrasts sharply with a seller’s market, where limited inventory forces buyers into bidding wars. In 2025, Florida is showing strong signs of shifting toward buyer-friendly conditions—especially in suburban and rural areas.

Key 2025 Trends in Florida Real Estate

- Inventory Surge: Many properties have entered the market post-pandemic, with developers rushing to meet previous demand.

- Price Stabilization: Home values are leveling out or even declining in some overbuilt regions.

- Incentive-Driven Deals: From free appliances to assistance with fees, sellers are actively sweetening the pot.

- Interest Rate Incentives: With slight easing in mortgage rates and lender-backed programs, qualified buyers are locking in attractive deals.

These elements together make 2025 a rare window of opportunity for both first-time buyers and seasoned investors looking for long-term value.

Is Florida a Buyer's Market in 2025?

Signs of a Buyer’s Market Across the State

Across Central and Northern Florida, and even in once-hot Southern markets, we’re seeing clear signs of a buyer’s market:

- Rising Days on Market (DOM): Homes are taking longer to sell.

- High Inventory Rates: More listings mean less urgency to make quick decisions.

- Frequent Price Drops: Price corrections are visible on platforms like Zillow and Realtor.com.

- Builder Concessions: Developers offer cashback, closing cost help, or home upgrades to close deals faster.

Effects on Property Values and Seller Strategies

With increased competition among sellers, many are adjusting expectations:

- Offering closing cost assistance.

- Including home warranties or smart home upgrades.

- Accepting offers below listing price.

Buyers, especially those with good credit and pre-approval, have the upper hand.

Where Are the Best Opportunities in Florida?

Undervalued Areas and New Construction Zones

Suburban and ex-urban regions offer untapped potential:

- Ocala – Known for affordability and large lot sizes.

- Lakeland – Strategic location between Tampa and Orlando.

- Gainesville – University town with high rental and resale potential.

Post-Pandemic Overexpansion Markets

Cities like Cape Coral, Fort Myers, and parts of Tampa Bay saw rapid pandemic-era growth. Now, they’re correcting, offering below-peak prices and enticing deals on newer builds.

Benefits for Buyers in 2025

Price Negotiation Power

In 2025, buyers can:

- Negotiate purchase price reductions.

- Request seller-paid closing costs.

- Take their time choosing the right home without rush.

Incentives and Seller Concessions

It’s not uncommon to find listings that offer:

- Free appliance packages.

- Interest rate buy-downs.

- Prepaid HOA fees or property tax credits.

Hometown Heroes Florida/2025

Who qualifies?

- Public school teachers

- Firefighters and paramedics

- Nurses and nursing assistants

- Police officers and correctional officers

- Veterans and active-duty military

- Occupational and physical therapists

- Social workers

- School bus drivers

- Healthcare workers in general

The full list is available on the official Florida Housing site: FloridaHousing.org

Benefits

- Receive up to $35,000 for down payment and closing costs.

- Buy a home up to $800,000 with little to no money out of pocket!

How much can you get?

Roughly 5% of the purchase price:

- $300K = $15,000

- $500K = $25,000

- $700K = $35,000

Loan Compatibility and Flexibility

The program works with:

- FHA Loans

- VA Loans

- USDA Loans

- Conventional Loans

Attention

Funds are LIMITED and expected to run out within 2-3 months after July 1st, 2025!

This could be your chance to finally become a homeowner in Florida.

How to Apply for Hometown Heroes

Steps to Take

- Contact a Florida Housing-approved lender or broker.

- Submit documentation verifying employment and income.

- Complete buyer education course.

- Undergo standard mortgage approval.

Where to Find Help

- Visit: floridahousing.org

- Speak with a local mortgage broker or real estate agent experienced in state programs.

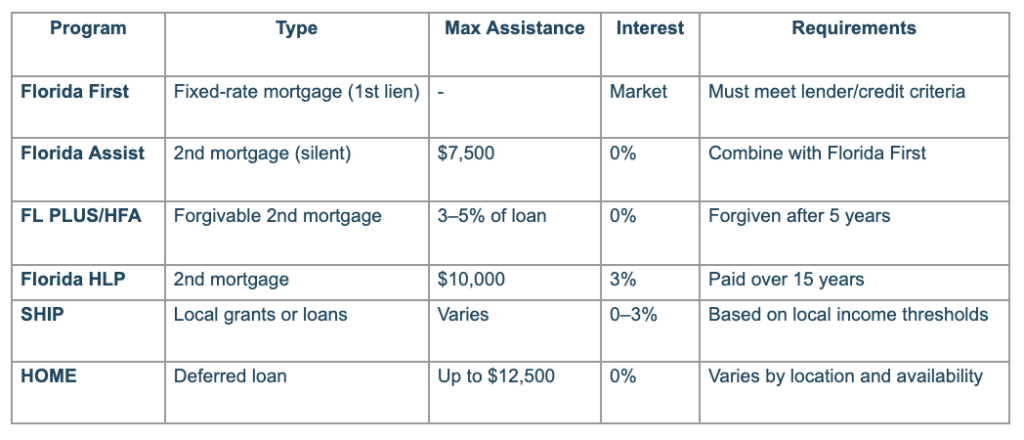

Additional Florida Programs for First-Time Buyers

Conclusion

If you’ve been waiting for the right time to buy your first home in Florida, 2025 may be your golden window. With the Buyer’s Market giving you negotiation leverage and powerful state programs like Hometown Heroes offering up to $35,000 in financial aid, essential professionals have more tools than ever to step into homeownership.

Don’t let this opportunity slip by—consult a certified real estate agent or mortgage specialist today to see how you can make the most of Florida’s real estate conditions.

Ready to own your first Florida home?

Take advantage of 2025’s buyer-friendly market and up to $35,000 in aid. Contact me today!

Here are the most frequently asked questions

Hometown Heroes is specifically for essential workers and offers up to $35,000. Florida Assist is open to first-time buyers and offers up to $7,500.

Most assistance is structured as deferred loans or forgivable after a set period, depending on the program.

Yes, many programs can be layered to maximize assistance—especially Florida First with Florida Assist or Hometown Heroes.

Check the official list at floridahousing.org for approved professions.

You must live and work in Florida and meet all other program requirements.

Yes. Most programs require a minimum credit score—usually 640 or higher for Hometown Heroes.